How to Miss By a Mile: An Alternative Look at Uber’s Potential Market Size

Background

- Aswath Damodaran (finance professor-NYU’s Stern school of business) published a article titled “uber isn’t worth $17 billion.”

- Using the combination of market data, math and financial analysis, he concluded that best estimated value for the uber is $5.9billion.

- This estimate of value was tied to certain “assumptions” with respect to TAM (total available market) as well as Uber’s market share within that TAM.

- Deep research and quantitative framework are missing in today’s short span approach.

- Hard number sometime can give us false sense of security.

- Damodaran uses two primary assumptions that drive the core of his analysis.

- TAM

- uber’s market share within that market

- TAM for the uber is the global taxi and car service market.

- He calculated global market and valued it $100 billion it include taxi and limousine market.

- He calculate the market share and assume that the company could cover 10%.

Critics in Damodaran’s method.

- Future will be same as the past as he use historical size of the taxi and limousine market.

- did not consider the impact of price on demand.

- Didn’t consider this possibility that ,could Uber reach a point in terms of price and convenience that it becomes a preferable alternative to owning a car?

There are critical error in both of these two core assumption.

- TAM

- Uber’s market share within that market

TOTAL AVAILABLE MARKET ANALYSIS (TAM)

- When you materially improve an offering, and create new features, functions, experiences, price points, and even enable new use cases, you can materially expand the market in the process.

- Uber’s potential market is far different from the previous car-for-hire market, precisely because the numerous improvements with respect to the traditional model lead to a greatly enhanced total available market.

What makes uber different from the taxi service is that :-

- Pick-up times.

- where Uber has high liquidity, you have average pick-up times of less than five minutes.

- As Uber becomes more established in a market, pick-up times continue to fall, and the product continues to improve.

- Coverage density

- enlarged coverage area not only increases the number of potential customers, but it also increases the potential use-cases.

- Uber is already achieving liquidity in geographic regions where consumers rarely order taxis, which is explicitly market expanding

- Payment

- Uber you never need cash to affect a transaction.

- Solely rely on smartphone.

- It also removes a time consuming and unnecessary step from the previous process.

- Civility

- The dual-rating system in Uber (customers rate drivers and drivers rate customers) leads to a much more civil rider/driver experience.

- Trust and safety

- Uber riders believe they are safer in an Uber than in a traditional taxi.

- Because there is a record of every ride, every rider, and every driver, you end up with a system that is much more accountable than the prior taxi market.

Different economics

- Uber becomes more and more liquid, its drivers enjoy higher and higher utilisation.

- Utilization is a measure of the percentage of time drivers are working versus waiting.

- As utilisation rises, über can lower price, and the drivers still make the same amount.

- In NYC today there are 13,605 licensed taxis. In 1937, when the modern system was created, there were 11,787. Additionally, prices only go up, they never go down.

New use cases :-

- Use in less urban areas

- Because of the magical ordering system and the ability to efficiently organize a distributed set of drivers, it can operate effectively in markets where it simply didn’t make sense to have a dense supply of taxis.

- In suburban areas where it takes less than 10 min to pickup is new use cases versus a historical model.

- Rental car alternative.

- Now no need to rent a car, wait for bus, now use uber.

- The rental car market is $27B in the U.S. The global market would obviously be much larger. And you are also eating into the parking market here.

- Transporting kids

- Parents are using uber to send their kids to different events.

- Mom’s van is called Uber

- Supplement for mass transit.

- who primarily uses mass transit, likely to consider UberX(low pricing).

- Lower price points than a taxi and more reliability make this possible.

THE GAME CHANGER: UBER AS A CAR-OWNERSHIP ALTERNATIVE.

- According to Ferenstein, “AAA estimates that the average cost of car ownership per year is about $9,000.”

- If you take that number and divide it by your average Uber fare, you can calculate the number of rides you could afford per year and compare that with your actual travel needs.

- According to Edmunds, car ownership among 18–34 year olds has fallen a full 30% in recent years.

There are two points worth considering with the spec to Uber has a car ownership alternative

- The consumer is most likely to replace their extra first car.

- Urban family going from two > one

- Suburban family reduce 4>3, 3>2 cars

- The fixed costs of this marginal car are very high (DMV registration, insurance, depreciation), yet the usage of that car is much lower

- Certain people the benefits of not driving are so high that they will switch to Uber before the economic case is specifically advantageous, choosing to pay a premium for the convenience.

HOW BIG IS THE CAR-OWNERSHIP-ALTERNATIVE MARKET?

- According to the NADA report, total dealership sales (including service) amount to about $730 billion annually. However, that doesn’t capture the entire car replacement market.

- Car replacement includes all ownership costs — not just the car purchase, but also insurance, DMV registration, parking, gasoline, repairs, and maintenance.

- There are just over 1 billion cars in circulation globally, with approximately 25% of them located in the United States.

- AAA estimates that the average annual cost of owning a car is about $9,000. Even after conservatively reducing this by 33%, it still amounts to $6,000 per year.

- One billion global cars multiplied by an annual $6,000 ownership cost equals a massive $6 trillion global market for car ownership expenses.

- With 25% of that market in the U.S., Uber’s potential reach is enormous and strategically advantageous.

- Uber’s total addressable market (TAM) is much larger than the traditional for-hire market because of its numerous improvements to efficiency, trust, and convenience.

WHY ONLY 10%?

- Damodaran argues that regulatory restrictions and competition will limit Uber’s market share.

- Technology businesses, unlike traditional industrial businesses that face diminishing marginal returns, experience a phenomenon known as “increasing returns.”

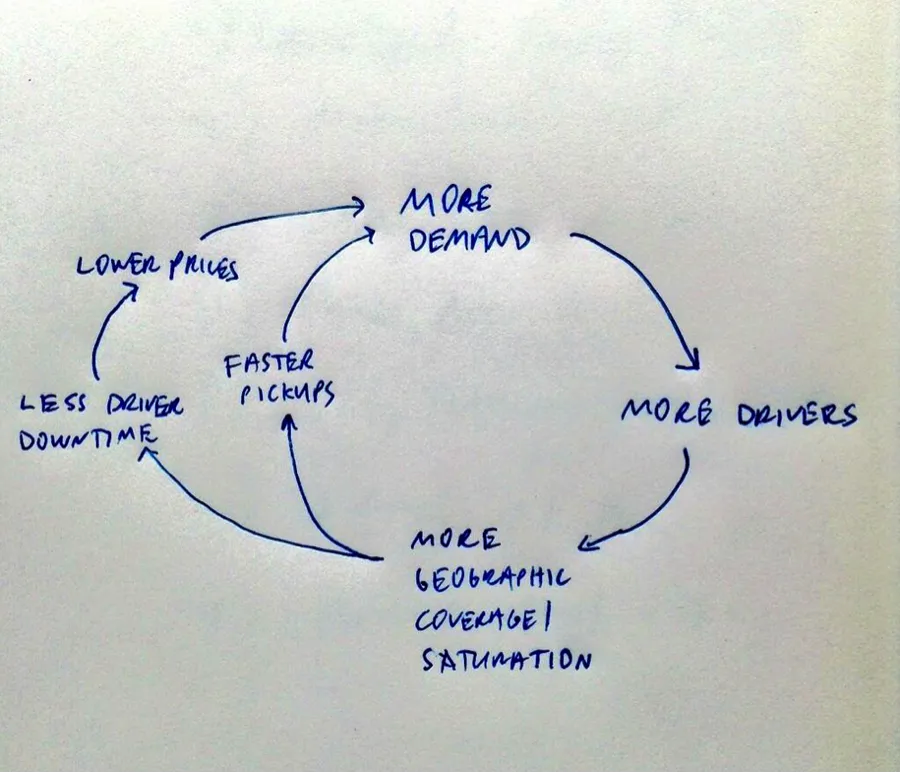

- Gaining market share puts such companies in a stronger position to gain even more, creating a self-reinforcing growth loop.

- Increasing returns are especially powerful when a network effect is present.

- A network effect occurs when “the value of a product or service depends on the number of others using it.” In other words, the more people who use Uber, the more valuable it becomes for everyone involved — both riders and drivers.

- The key question is whether Uber benefits from this network effect, where each additional user experiences higher utility because of previous users — potentially leading to a market share far beyond the 10% suggested by Damodaran.

There are three drivers of the network effect in Uber model.

- Pickup- times.

- Uber expands in a market, and as demand and supply both grow, pickup times fall.

- The more people that use Uber, the shorter the pick up times in each region.

- Shorter pickup times mean more reliability and more potential use cases.

- Coverage density.

- Uber grows in a city, the outer geographic range of supplier liquidity increases and increases.

- More the service is used , greater will be coverage.

- Utilisation

- the time that a driver has a paying ride per hour is constantly rising.

- 🚀demand and 🚀supply make the economical traveling-salesman type problem easier to solve.

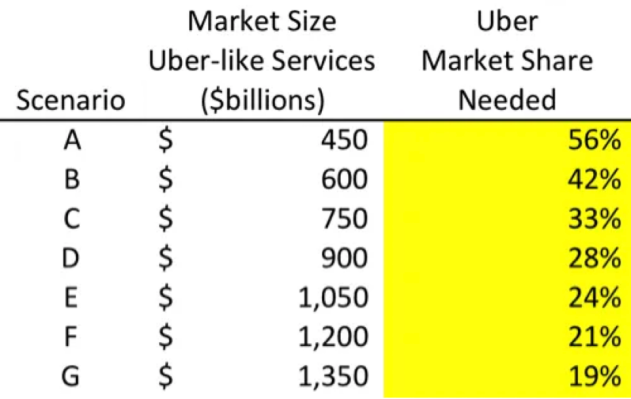

PROPOSED ESTIMATES (25X)

- Uber’s potential market could be 25 times higher than Damodaran’s original estimate.

- His original estimate was based on Uber topping out at 10% of a $100 billion market. $10 billion market’s share.

- But, features and functions of Uber’s new car-for-hire service significantly expands the core market.

- Based on SF, market was already 3X.

-

Two reasons that this 3X market multiplier is the low end of the range because:

- In SF Uber is growing aggressively, new market is far from saturated.

- These services are succeeding in areas where taxis were previously not prevalent.

- Expanded car-for-hire market is 3–6X bigger than historic market. Car ownership alternative market.

- On combining these two opportunities, New TAM is estimated from $450 billion to $1.3 trillion.

- Key objective of this exercise is to present a reasonable and plausible argument that Uber’s market opportunity might be 25X higher.

- This case is made without any consideration for whether Uber can impact the logistics market or expands into any incremental services whatsoever.

Author:

Vins Rafaliya